Markets Confusing? Ask Edgen Search.

Instant answers, zero BS, and trading decisions your future self will thank you for.

Try Search Now

0G: The Core AI Layer

0G: The Core AI Layer

This report helps users understand 0G, an AI blockchain, by focusing on its team, funding, value, and airdrop chances. For new users, You can read a guide about 0G here

TL;DR

- 0G is poised to become the foundational layer for on-chain AI, unlocking a new era of high-performance decentralized applications.

- Backed by a world-class team and over $359 million in capital from premier institutional investors, the project has a formidable foundation for execution and long-term success.

- The project's unique, high-throughput architecture and strategic focus on AI-specific use cases create a significant, defensible market opportunity.

- The upcoming Token Generation Event and Mainnet launch are key catalysts that will transition 0G from a promising venture to a live, operational network.

What is 0G?

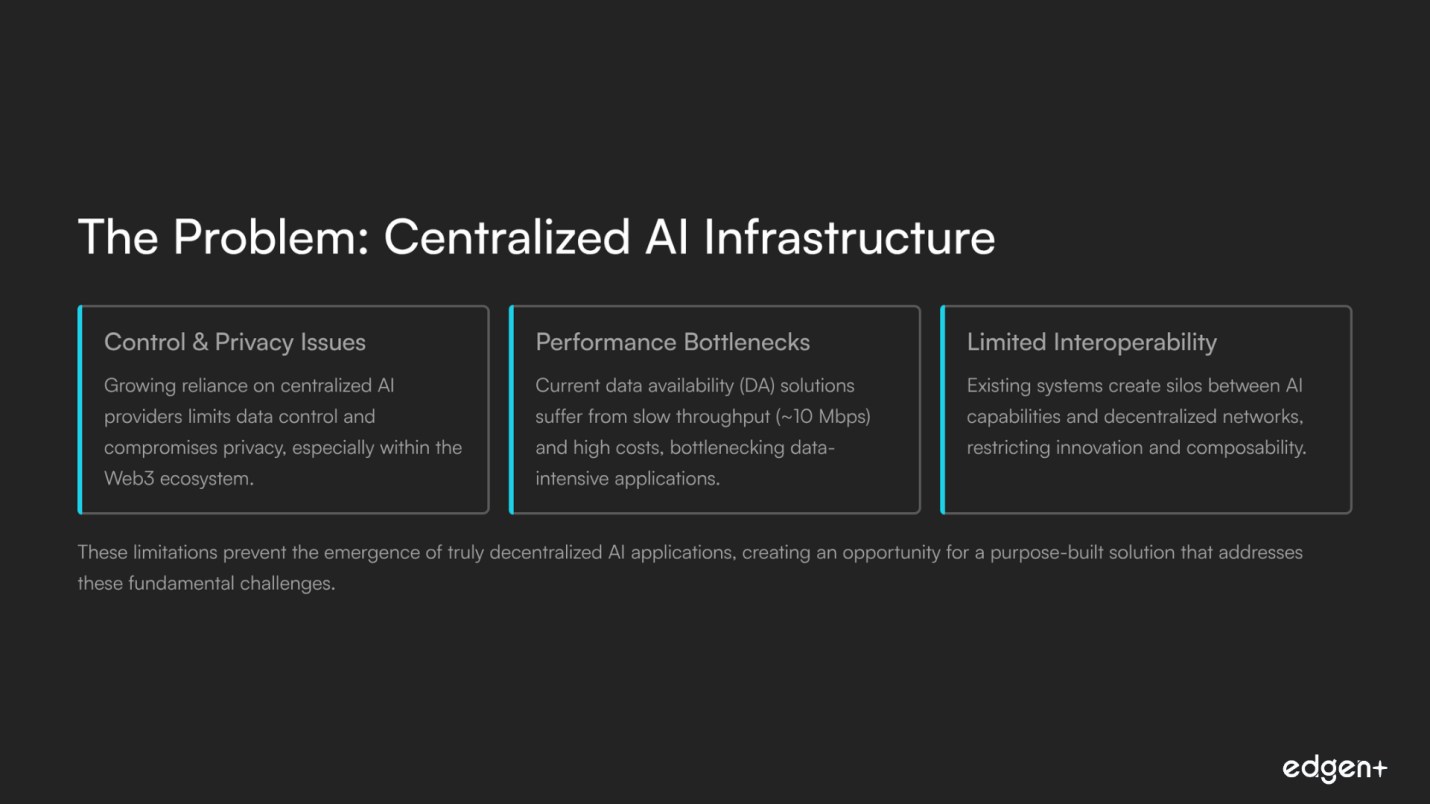

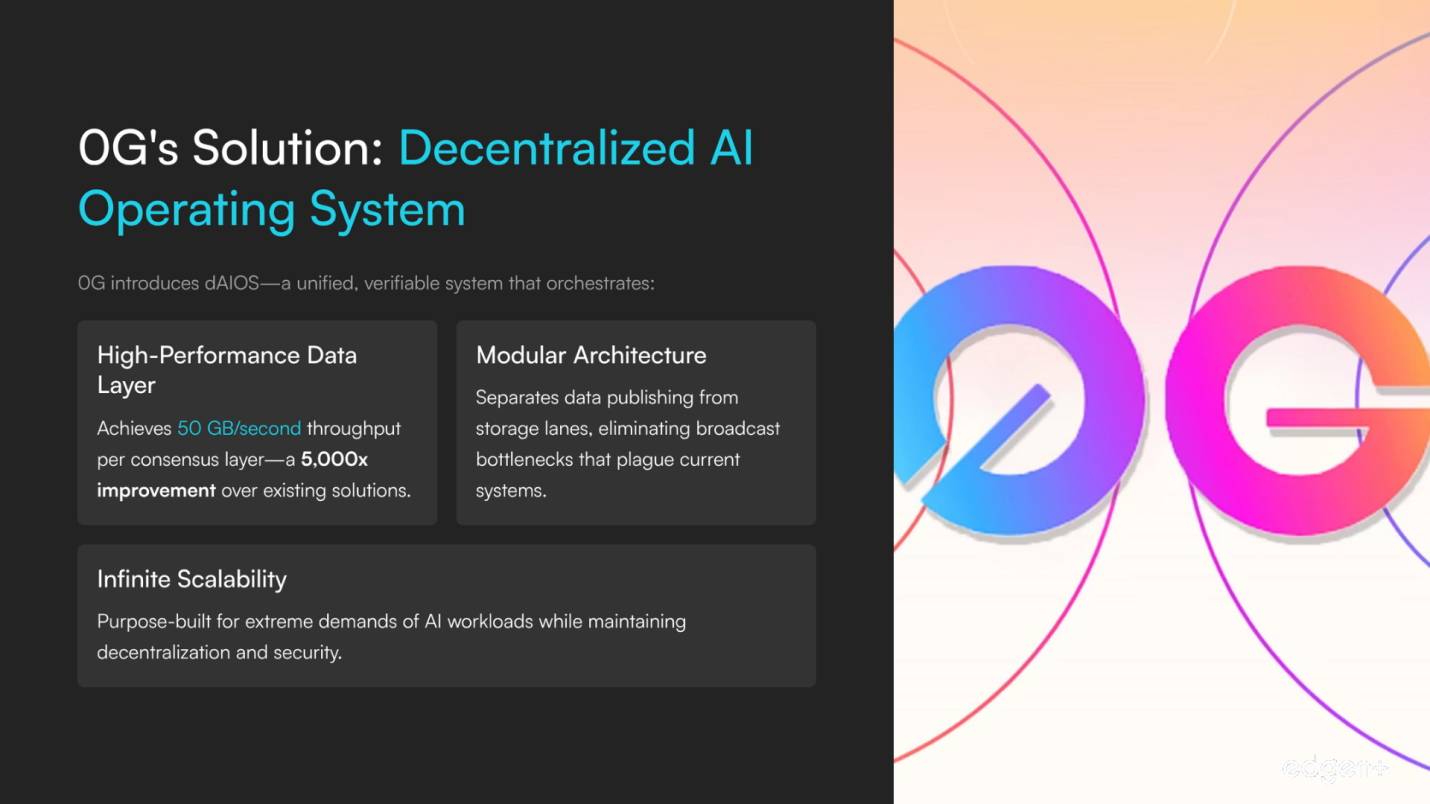

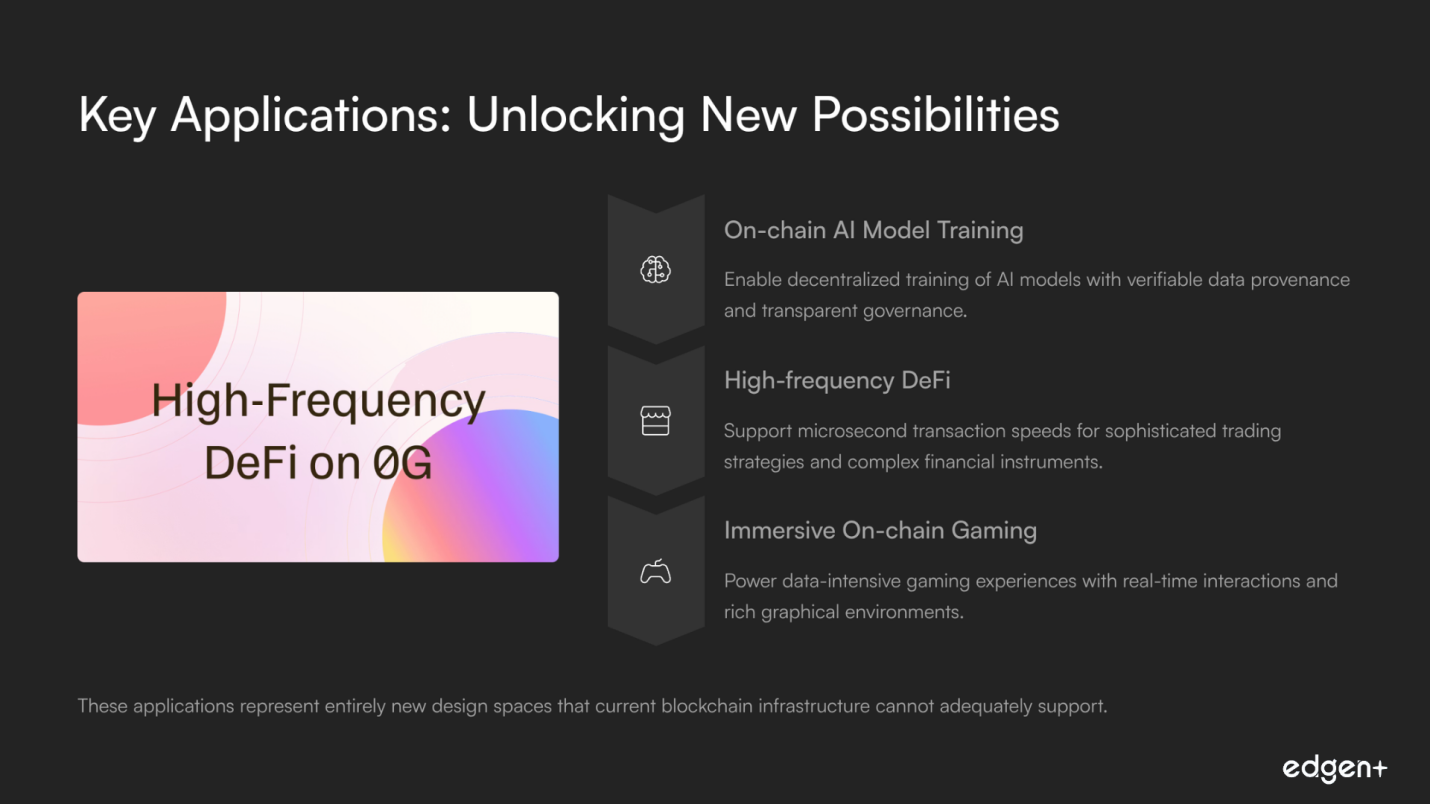

0G is a modular blockchain project designed to serve as the foundational "Artificial Intelligence Layer" (AIL) for the decentralized internet. Its mission is to make AI a public good by providing a high-performance, cost-effective infrastructure layer for on-chain AI applications. The project addresses the critical issues of slow throughput and high costs associated with existing data availability (DA) solutions, which currently bottleneck data-intensive use cases. By proposing a "Decentralized AI Operating System" (dAIOS), 0G aims to unify decentralized compute, storage, and data availability into a single, verifiable system. This architecture is purpose-built to enable a new generation of on-chain applications, including AI model training, high-frequency decentralized finance (DeFi), and immersive on-chain gaming.

Foundational & Strategic Analysis

Strategic Vision and Investor Alignment

0G's strategic vision is to establish a new foundational layer for the decentralized internet, the "Artificial Intelligence Layer" (AIL), with the mission to "Make AI a Public Good." The project is designed to solve a critical market problem: the growing reliance on centralized AI providers, which introduces issues of data control, privacy, and limited interoperability, especially within the Web3 ecosystem. To address this, 0G's solution is a "Decentralized AI Operating System" (dAIOS). This modular platform orchestrates decentralized compute, storage, and data availability into a unified, verifiable system.

The project's strategic thesis is further strengthened by its direct confrontation with the technical limitations of contemporary data availability (DA) solutions. 0G’s core value proposition is a significant performance improvement, claiming its architecture can achieve throughput speeds of 50 GB/second per consensus layer. This is a crucial claim and the central pillar of its go-to-market hypothesis. By providing an "infinitely scalable" and high-performance data layer, 0G aims to become the default infrastructure for data-intensive use cases such as:

- On-chain AI model training

- High-frequency DeFi

- Complex on-chain gaming

This ambitious vision is strongly aligned with the theses of its key investors. For example, Dispersion Capital highlights its investment in 0G as a pioneer in the modular future of blockchain and on-chain AI. This investor perspective validates 0G's strategy of targeting a specific, high-value niche that requires performance beyond what current modular solutions offer.

Exceptional Team and Execution Prowess

The 0G core team presents a formidable combination of proven Web2 entrepreneurial success and deep, crypto-native technical expertise, significantly bolstering its execution credibility.

- CEO Michael Heinrich is a serial entrepreneur who previously founded a Y Combinator-backed company he scaled to over $200 million in revenue. His background at Microsoft, Bain & Company, and Bridgewater Associates indicates a strong capacity to scale high-growth technology companies.

- CTO Ming Wu and co-founder Fan Long are elite technical leaders from Conflux, with Ming Wu having over 11 years of experience as a lead researcher at Microsoft Research Asia and Fan Long holding a PhD in Computer Science from MIT.

This team composition points to a high capacity for navigating technological development, strategic fundraising, and market positioning at the highest level.

Strong Financial Backing and Endorsements

0G has secured an exceptionally strong capital position from a syndicate of top-tier, crypto-native venture capital firms, providing it with a substantial financial runway and powerful strategic endorsements.

- Cumulative Funding: Over $359 million, including a $35 million pre-seed round, a $40 million seed round, over $34 million from node sales, and a significant $250 million token purchase commitment from the 0G Foundation.

- Premier Investors: Funding rounds were led by Hack VC with participation from a roster of prominent Web3 investors, including Delphi Ventures, OKX Ventures, Bankless Ventures, Animoca Brands, and Samsung NEXT.

This capital base de-risks the project from near-term financial pressures and enables it to fund an aggressive roadmap, including an $88.88 million ecosystem growth program to attract developers and accelerate adoption.

Substantial Market Opportunity and Problem-Solution Fit

0G is strategically positioned to address the intersecting, high-growth markets of AI infrastructure and blockchain data availability, where its value proposition directly targets well-understood performance and cost limitations.

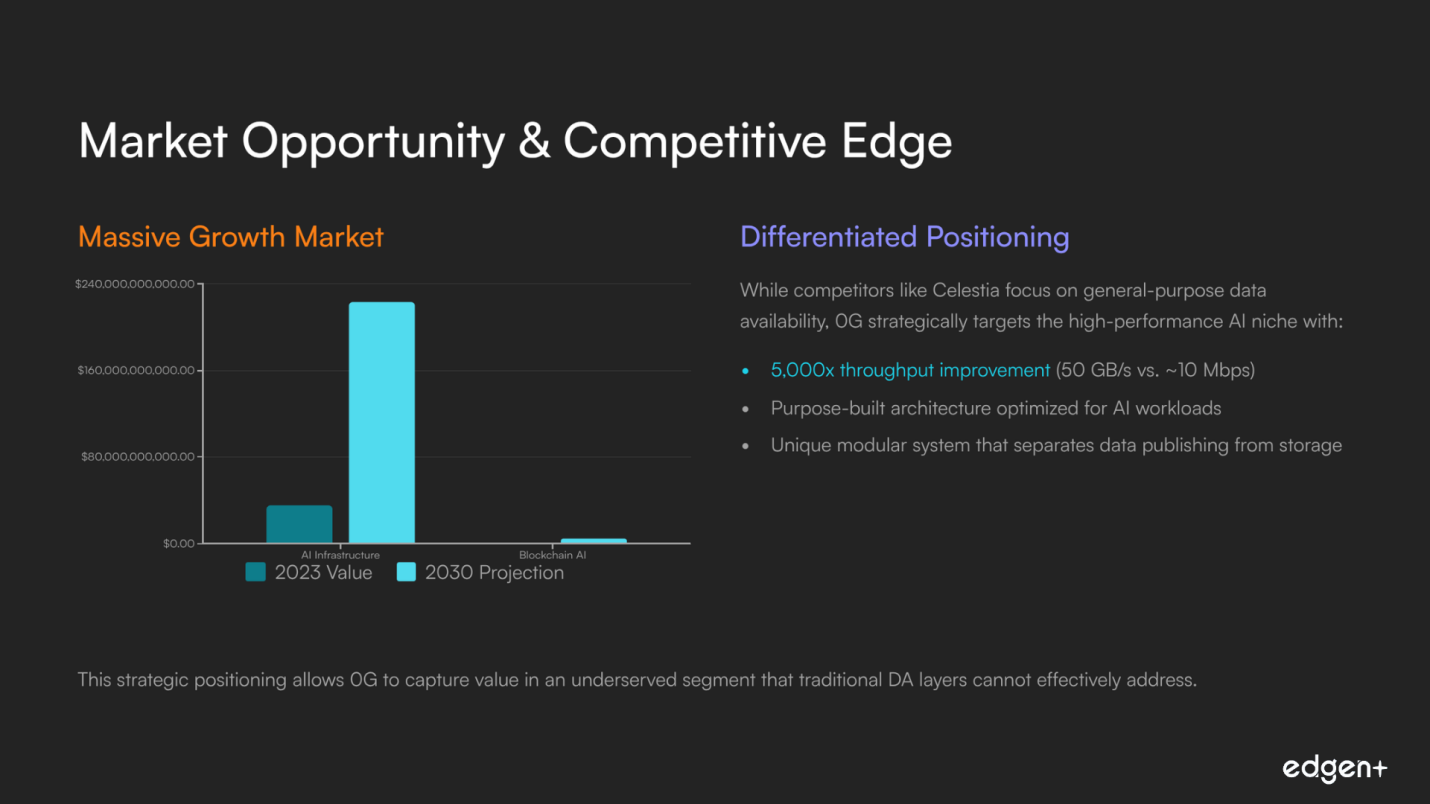

- Total Addressable Market (TAM): The global AI infrastructure market alone was valued at over $35 billion in 2023 and is projected to exceed $223 billion by 2030. The blockchain AI market is also forecast to grow significantly, from $680 million in 2025 to over $4.3 billion by 2034.

- Problem-Solution Fit: 0G aims to serve developers and data scientists building high-performance applications currently bottlenecked by the high costs and low throughput of existing DA solutions. The primary adoption driver is a dramatic reduction in cost and a radical increase in performance, which would not only optimize existing applications but also unlock entirely new design spaces.

The Differentiated Competitive Edge

0G enters a competitive field but strategically differentiates itself by targeting a high-performance niche—on-chain AI—that existing solutions are not architecturally optimized to serve.

- Performance: 0G's primary differentiator is its claimed step-function improvement in performance, targeting 50 GB/s throughput compared to Celestia's ~10 Mbps.

- Unique Architecture: 0G's primary moat is a modular system that separates the data publishing lane from the data storage lane, avoiding broadcast bottlenecks. This is a fundamental architectural choice, purpose-built for the extreme demands of AI

This unique positioning allows 0G to be a specialized, high-throughput "AI chain" rather than a generic DA layer.

Pre-Launch Ecosystem & Go-to-Market Analysis

Community and Narrative Momentum

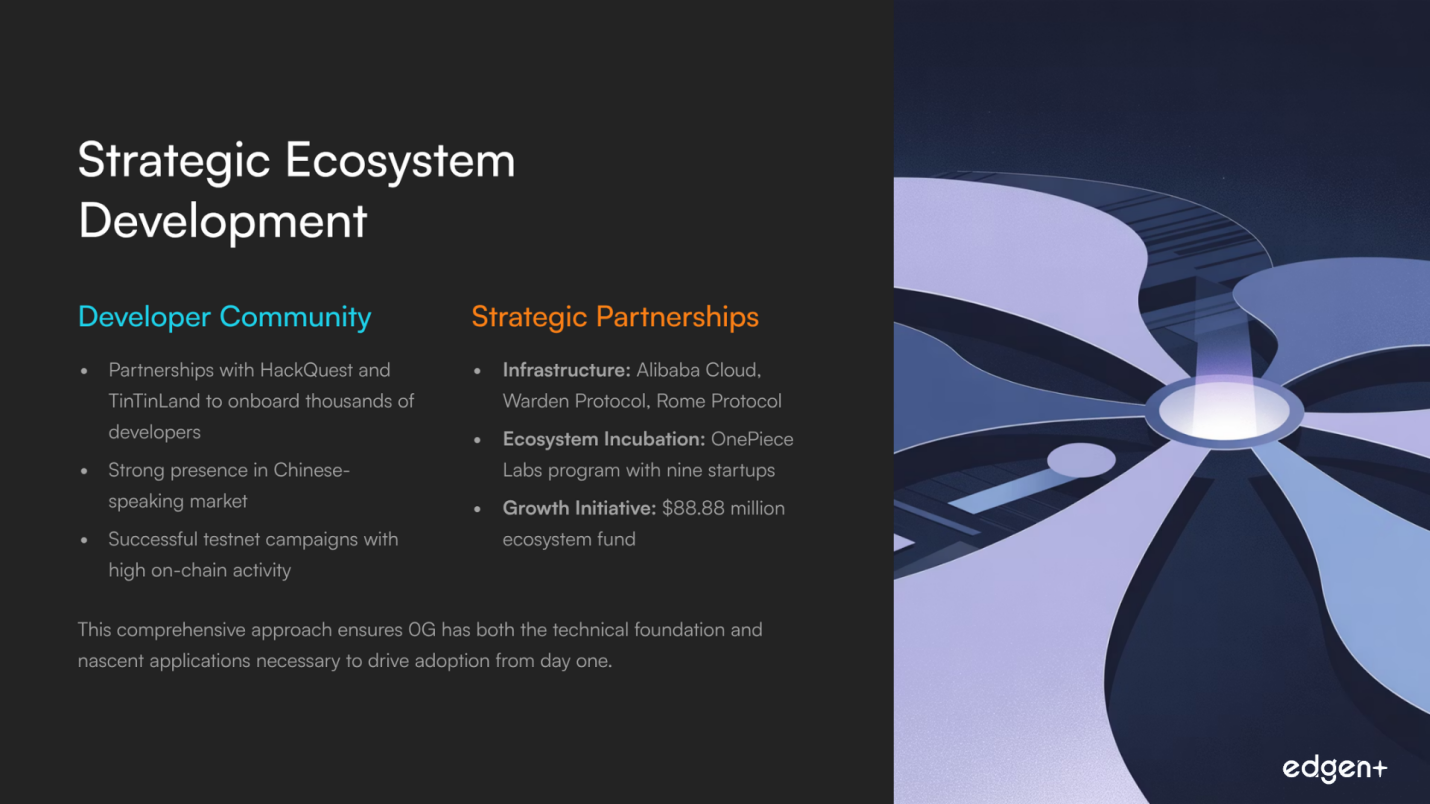

0G exhibits strong narrative momentum driven by high-level testnet metrics and a sophisticated regional developer strategy. The project's success in cultivating a dedicated developer community, particularly within the Chinese-speaking market, is a significant positive signal.

- Developer Outreach: Strategic partnerships with developer education platforms like HackQuest and TinTinLand are cultivating a genuine developer ecosystem with programs to onboard thousands of developers.

- Community Engagement: The project has successfully generated widespread participation through a well-documented airdrop campaign. The high volume of on-chain activity from its public testnets demonstrates the network's technical robustness.

Strategic Partnerships and Go-to-Market Readiness

0G has executed a sophisticated and comprehensive partnership strategy, building a broad ecosystem of collaborators that addresses both the supply and demand sides of its platform ahead of launch.

- Foundational Partners: Collaborations with Alibaba Cloud, Warden Protocol, and Rome Protocol aim to enhance the core capabilities and scalability of the 0G network.

- Ecosystem Incubation: An incubation program with OnePiece Labs includes a cohort of nine startups building directly within the 0G ecosystem. This multi-faceted approach demonstrates a clear strategy to ensure the network has both the technical underpinnings and nascent applications necessary to attract users and developers from day one.

Tokenomics and Value Accrual Model

The proposed tokenomics for 0G are structured around a fixed total supply of 1 billion $0G tokens with broad utility.

- Utility: The $0G token will be used for native gas fees, staking for network security, liquid restaking solutions, and as the payment medium for the platform's core services.

- Vesting: To mitigate immediate post-launch sell pressure, investor and node tokens are subject to a standard vesting schedule of partial unlock at TGE followed by a long-term linear release. This is a prudent and conventional approach to align long-term incentives and prevent a sudden supply shock.

Forward-Looking Analysis: Catalysts and Risks

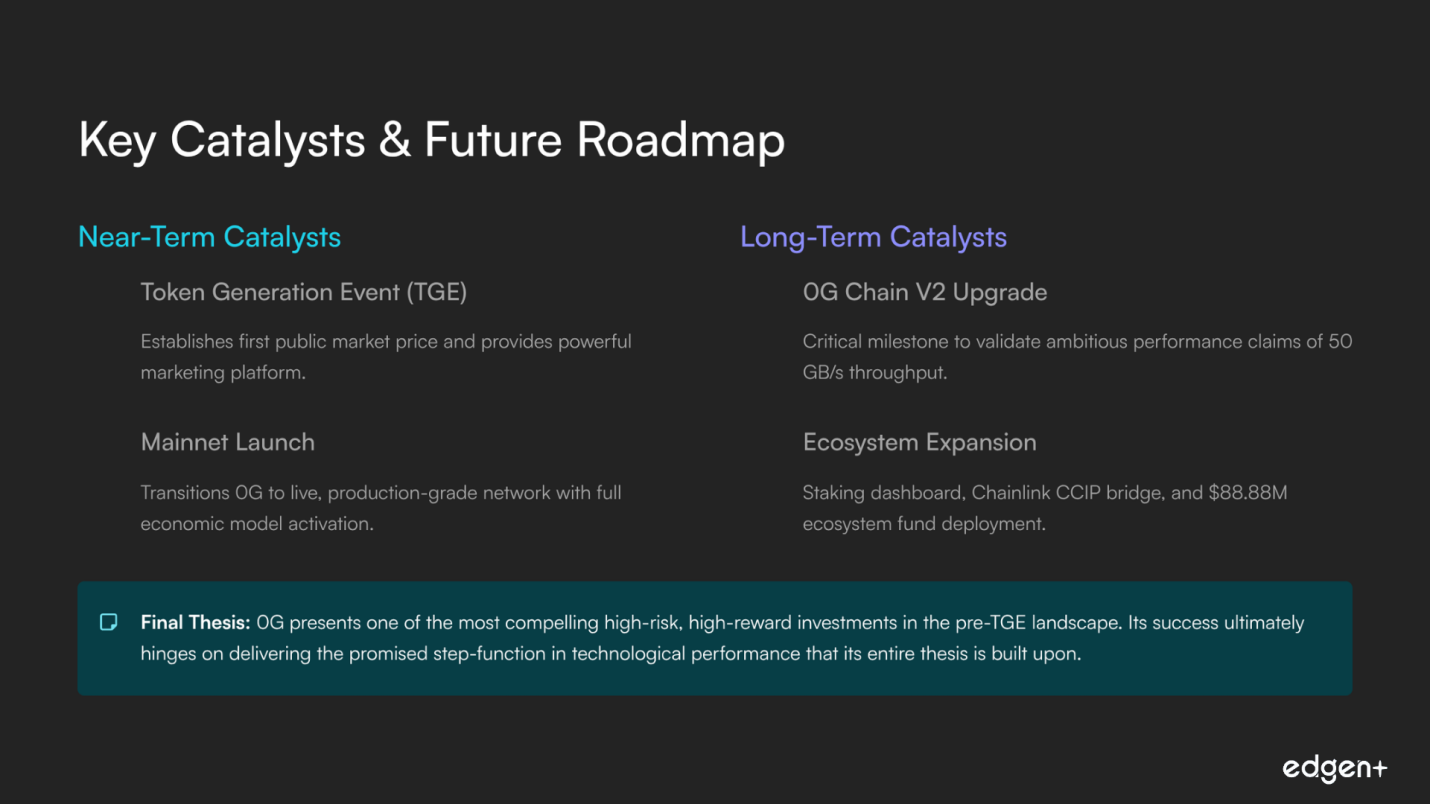

- Near-Term Catalysts: The Token Generation Event (TGE) and the subsequent initial exchange listing are the most significant near-term catalysts. This event will establish the first public market price for the $0G token and provide a powerful marketing and narrative-building platform. The Mainnet Launch, expected shortly after TGE, will transition 0G into a live, production-grade network and activate its full economic model.

- Long-Term Catalysts: The 0G Chain V2 Upgrade is the most critical long-term catalyst. If this upgrade successfully validates the project's ambitious performance claims, it would justify a premium valuation and attract a unique set of high-value dApps. The launch of a staking dashboard and a Chainlink CCIP bridge will also enhance usability and interoperability, driving value for the network.

Valuation Scenario Analysis

TGE Forecast: Fully Diluted Valuation (FDV)

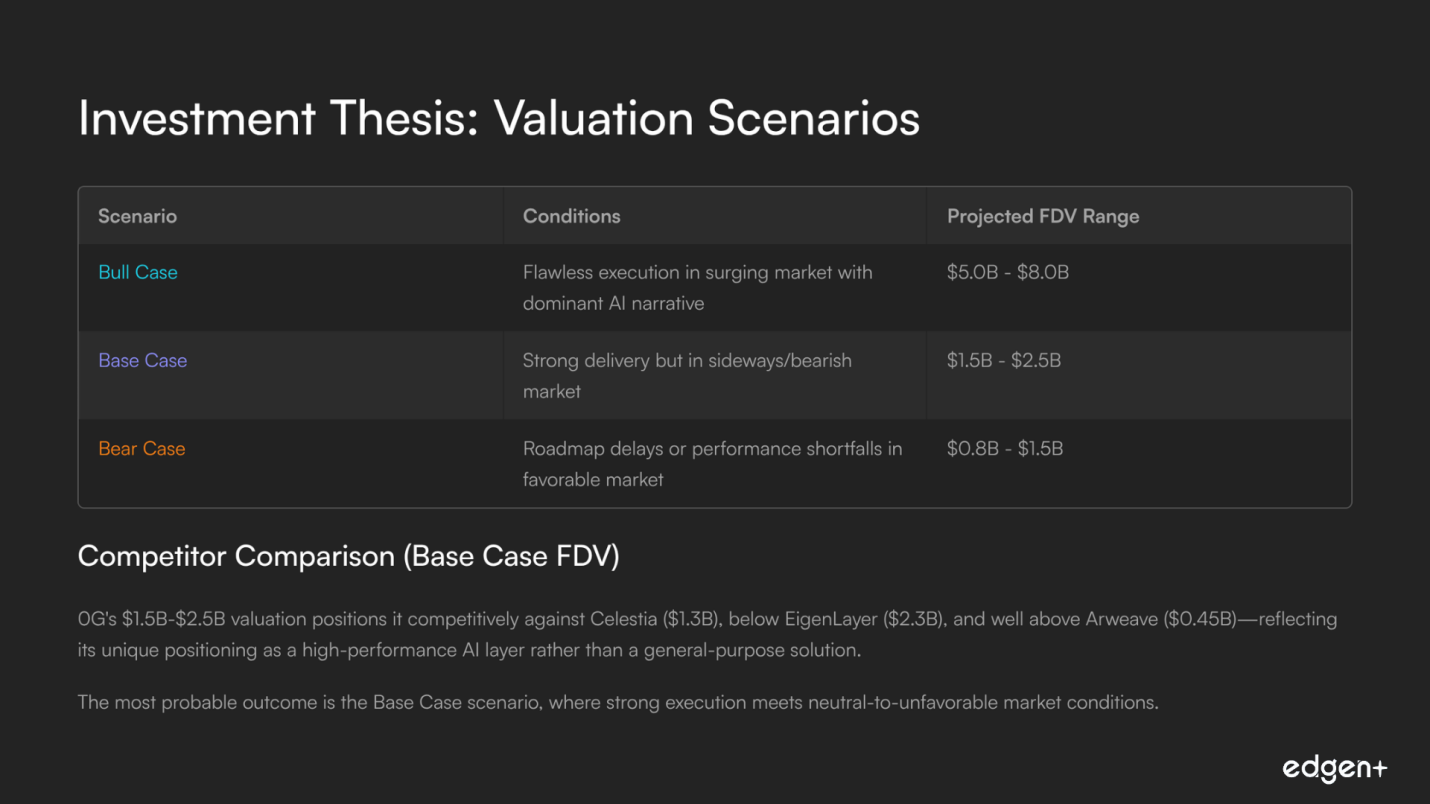

The potential valuation for 0G spans a wide range, reflecting its high-beta nature and reliance on key execution milestones. This table presents potential outcomes based on a blend of market conditions and project execution.

Scenario | Conditions | Justification | Projected FDV Range |

Bull Case | Strong Execution, Favorable Market | Flawless execution of technical roadmap in a surging crypto market with a dominant AI narrative. Successful validation of breakthrough performance establishes 0G as a new category-defining asset, justifying a significant valuation premium over public comparables. | $5.0B - $8.0B |

Base Case | Strong Execution, Unfavorable Market | Team successfully delivers on core technological promises, but into a sideways or bearish market. Valuation multiples are compressed across the sector, but 0G is still valued as a best-in-class asset, trading in line with or at a slight premium to established peers. | $1.5B - $2.5B |

Bear Case | Weak Execution, Favorable Market | Project suffers roadmap delays or fails to deliver on key performance promises, but a strong bull market provides a speculative floor. The token trades on narrative and strong backing rather than fundamentals, likely underperforming well-executed peers and trading at a notable discount. | $0.8B - $1.5B |

Competitor Landscape: TGE Token Comparison (Base Case)

0G's positioning as a high-performance AI layer is strategically differentiated from its competitors, which are more general-purpose data availability solutions.

Project (Ticker) | Primary Function / Market | Base Case FDV (Billions) | Key Differentiator |

0G (0G) | AI-Specific Data Availability | $1.5B - $2.5B | Purpose-built, high-throughput architecture for on-chain AI and data-intensive applications, targeting 50 GB/s throughput. |

Celestia (TIA) | General-Purpose Modular DA Layer | $1.3B | Pioneer of the modular blockchain thesis, separating execution from data availability. |

EigenLayer (EIGEN) | Restaking Protocol & AVS | $2.3B | Utilizes Ethereum's security budget to secure new AVS (Actively Validated Services), creating a shared security layer for middleware. |

Arweave (AR) | Permanent Decentralized Storage | $0.45B | Offers permanent, one-time payment storage. It is not a real-time data availability layer. |

NEAR Protocol (NEAR) | L1 Blockchain, Multi-Purpose | $6.8B | Sharded L1 with a focus on developer experience and a robust ecosystem, but not specifically optimized for real-time AI data. |

Final Thesis

0G presents one of the most compelling high-risk, high-reward investment profiles in the pre-TGE landscape. Its exceptional founding team, formidable capital position, and visionary goal to build the foundational layer for on-chain AI provide a powerful foundation for success. The most probable outcome is the Base Case scenario, where the strong team executes well but is constrained by neutral-to-unfavorable market conditions, leading to a valuation in the $1.5B-$2.5B FDV range. Ultimately, 0G's success hinges on its ability to deliver the promised step-function in technological performance that its entire thesis is built upon.

.32b68d3b2129e802.png)

.ee9b0bcf9fc168ac.png)

.d8688e9eeef29939.png)