Markets Confusing? Ask Edgen Search.

Instant answers, zero BS, and trading decisions your future self will thank you for.

Try Search Now

Hyperliquid: The On-Chain Financial Hub

Hyperliquid is a high-performance, purpose-built Layer 1 blockchain and decentralized perpetuals exchange, architected from first principles to become a unified, on-chain financial hub that combines the speed and user experience of a centralized exchange with the security and transparency of decentralized finance. For $HYPE Guide, click here

TL;DR

- Hyperliquid has achieved remarkable foundational strength, successfully building a fully on-chain order book that sets a new industry benchmark for performance and user experience.

- The protocol has a unique and powerful value accrual flywheel, directing over 90% of its substantial revenue back to the HYPE token through strategic buybacks.

- Hyperliquid has attracted formidable institutional backing and validation through innovative public market vehicles, aligning its long-term vision with sophisticated capital.

- The project is positioned to capture a significant share of the rapidly growing multi-trillion dollar crypto derivatives market, with a clear path to becoming a dominant piece of core DeFi infrastructure.

What is Hyperliquid?

Hyperliquid is a groundbreaking DeFi protocol that is much more than just a perpetuals exchange. It's a vertically integrated Layer 1 blockchain, purpose-built with a custom consensus algorithm and execution environment. This unique architecture enables it to offer a high-performance, fully on-chain Central Limit Order Book (CLOB), a feat that has historically been considered a major challenge in decentralized finance. The platform's mission is to become a comprehensive on-chain financial system, providing a secure, transparent, and highly performant alternative to traditional centralized exchanges. By combining the best features of both worlds—CEX-level speed and DEX-level security—Hyperliquid is building the foundational infrastructure for the next generation of finance.

Part I: Foundational & Strategic Analysis

Strategic Direction & Narrative Trajectory

Hyperliquid's strategic vision is to become a foundational "DeFi financial hub," uniting a fragmented crypto landscape under a single, high-performance L1. This ambition is embodied in its characterization as an "on-chain Binance," a narrative that effectively communicates its goal of replicating the product depth and user experience of a leading centralized exchange with the core tenets of decentralization and self-custody. This positioning places Hyperliquid at the heart of several powerful market narratives, including the ongoing capital rotation from CEXs to DEXs and the demand for robust, high-performance DeFi infrastructure. Its success is intrinsically linked to its ability to execute this vision, which it has demonstrated with a superior, low-friction user experience that abstracts away blockchain complexities while upholding the core value propositions of verifiable, on-chain transparency.

Product & Technology Prowess

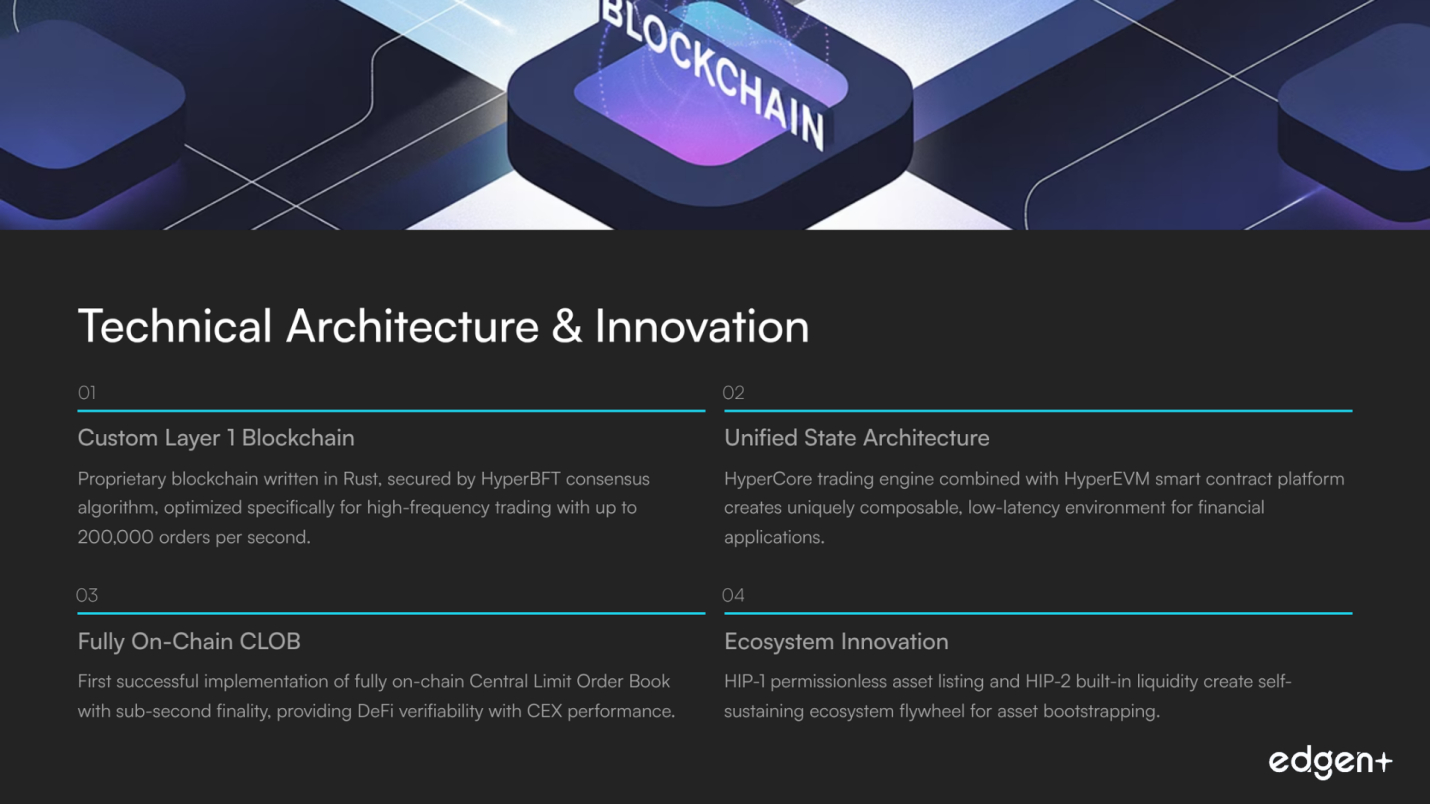

The Hyperliquid platform is built on a custom, vertically integrated technology stack designed from first principles to overcome historical performance limitations in on-chain order books.

- Core Architecture: The protocol is a proprietary Layer 1 blockchain written in Rust, secured by a custom consensus algorithm named HyperBFT. This architecture is uniquely optimized for high-frequency trading, enabling exceptionally high throughput (up to 200,000 orders per second) with sub-second finality. Its unified state architecture, which combines the HyperCore trading engine with a general-purpose smart contract platform, HyperEVM, creates a uniquely composable and low-latency environment for financial applications.

- Key Innovations: Hyperliquid's technical edge lies in its uncompromising commitment to a fully on-chain CLOB. This provides the verifiability of DeFi without sacrificing the performance expected from a CEX. The protocol’s innovative Hyperliquid Improvement Proposals (HIPs) for permissionless asset listing (HIP-1) and built-in liquidity (HIP-2) have created a novel, self-sustaining ecosystem flywheel for asset bootstrapping that is difficult for competitors to replicate.

Market Adoption & Developer Activity

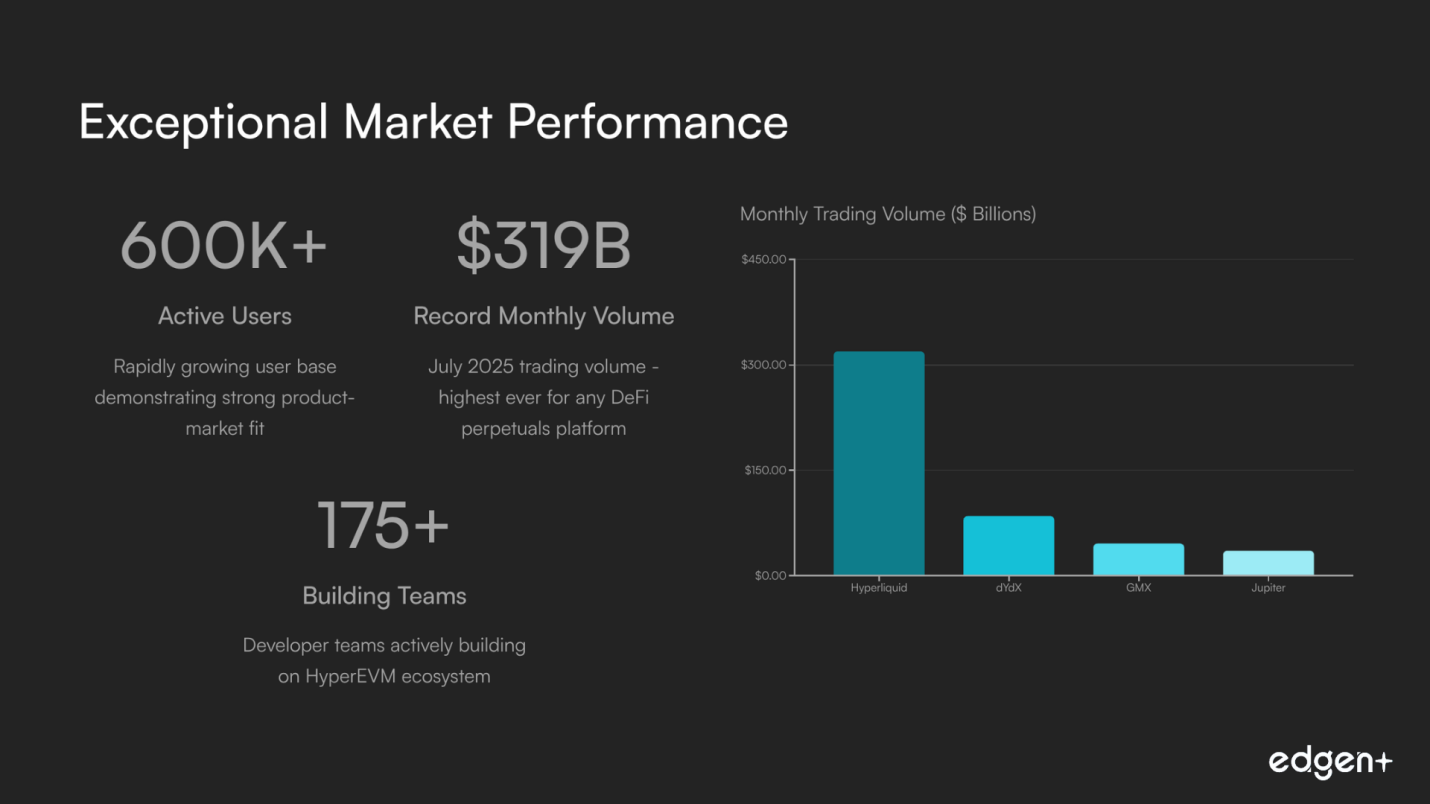

Hyperliquid has achieved remarkable market adoption and demonstrates strong momentum. The platform’s user base has grown to over 600,000 users, fueled by record-breaking transaction volumes. In July 2025, the platform processed a record-breaking $319 billion in trading volume, making it the highest monthly figure ever recorded for any DeFi perpetuals platform. This is a clear indicator of strong product-market fit. On the development front, while the core protocol is maturing, the broader ecosystem shows significant momentum. Over 175 teams are publicly building on HyperEVM, creating a vibrant ecosystem of tools and applications that further enhance the platform's utility and network effects.

Team & Backers

The project's success is directly attributable to the exceptional technical proficiency of its core team. Led by co-founder Jeff Yan, a former physics prodigy and veteran of elite high-frequency trading firm Hudson River Trading (HRT), the team possesses a profound, first-hand understanding of the technical requirements for a superior trading venue. The core team of 10-11 members is composed of highly skilled professionals from top-tier academic institutions and leading quantitative finance firms.

Despite its "community-first" narrative and decision to self-fund early development, Hyperliquid has attracted formidable institutional backing. This has been secured through innovative public market treasury strategies from Nasdaq-listed companies and major players like Paradigm, Galaxy Digital, Pantera Capital, and D1 Capital who have supported the formation of a publicly listed entity to acquire HYPE. This provides both significant capital and a powerful social endorsement without compromising its community-centric tokenomics.

Brand & Ecosystem Longevity

Hyperliquid is rapidly building a brand synonymous with "performance DeFi." Its core narrative of a high-speed, fully on-chain CLOB has resonated deeply with sophisticated traders and a community of technically-minded users. The brand’s longevity is further supported by strategic partnerships with major ecosystem players, such as Circle and Phantom Wallet, which expand its reach and usability. The flourishing developer ecosystem building on HyperEVM ensures that the platform's utility will continue to grow, moving beyond its core trading engine to support a wide range of financial applications and solidifying its position as a durable piece of decentralized financial infrastructure.

Part II: On-Chain & Market Depth Analysis

Sustainable Tokenomics & Value Accrual

Hyperliquid has engineered a compelling tokenomic model designed for long-term sustainability. The core of this model is a direct and potent value accrual flywheel that channels an industry-leading 91% to 97% of all protocol revenue back to the HYPE token. This revenue is used to systematically buy back HYPE from the open market, creating a powerful and continuous source of buying pressure. In addition to buybacks, a portion of the spot exchange fees is used for a permanent token burn, adding a deflationary element. This aggressive revenue redistribution model provides a strong fundamental basis for the token's value and creates a powerful positive feedback loop: as trading volume increases, protocol revenue grows, leading to more buybacks and a stronger HYPE token.

Token Holder Distribution & On-Chain Metrics

While comprehensive on-chain data is limited, available analysis suggests a high concentration of ownership among a small number of addresses. However, this is balanced by strong evidence of sophisticated, institutional-scale accumulation. Entities like Anchorage Digital and Nasdaq-listed Hyperion DeFi have made significant public disclosures about their holdings, providing a strong signal of conviction. This suggests that the on-chain landscape is characterized by high-conviction institutional holders, who are accumulating positions based on the project's robust revenue generation and value accrual model, rather than short-term retail speculation.

Awareness & Mindshare Analysis

Hyperliquid's social momentum has successfully navigated the classic crypto hype cycle, transitioning from an airdrop-driven narrative to a mature brand. While social dominance has cooled from its May 2025 peak, it has settled into a stable, healthy range, and the narrative has evolved beyond speculation to focus on the project's established role as a dominant piece of DeFi infrastructure. The positive-to-negative sentiment ratio remains strong at approximately 3.75-to-1, indicating a resilient and committed community that has a deep understanding of the project's long-term value proposition.

Part III: Forward-Looking Analysis (Catalysts & Risks)

Near-Term Outlook (<1 Month)

The current state of the on-chain derivatives market for HYPE presents both a catalyst and a risk. The presence of numerous large, multi-million dollar positions indicates strong institutional participation, which directly translates into high trading volume and significant protocol revenue. However, the lack of a clear directional bias among these large positions creates the potential for short-term volatility. The market may experience a rapid price movement triggered by a cascade of liquidations, which, while risky, could also be a catalyst for further price discovery if the liquidations are absorbed by other large, long-term players.

Mid-Term Outlook (1-3 Months)

Hyperliquid's primary catalyst in the mid-term is the continued exponential growth of the decentralized perpetuals sector. As the sector continues to capture market share from centralized exchanges, Hyperliquid, as the market leader, is strategically positioned to be the primary beneficiary. The successful launch and adoption of Jupiter's new JupNet private testnet pose a potential risk as a competitor product, but Hyperliquid's superior L1 architecture and performance provide a strong moat. The market will closely observe how Hyperliquid’s on-chain metrics, like trading volume and TVL, respond to this new competitive dynamic.

Long-Term Outlook (6+ Months)

The most significant long-term catalyst for Hyperliquid is the strategic rollout of its "Future Emissions and Community Rewards" allocation (38.88% of supply). While this lack of a defined schedule poses a current uncertainty, a well-executed plan to deploy these tokens for long-term growth—for example, through sustained liquidity mining campaigns or a new generation of ecosystem grants—could ignite a new phase of growth and solidify its market dominance. A key risk to monitor is the Core Contributor token unlock scheduled for late November 2025. While a predictable event, it could create temporary sell pressure, requiring strong narrative management to mitigate market concerns.

Part IV: Valuation & Competitive Position

Valuation Scenarios

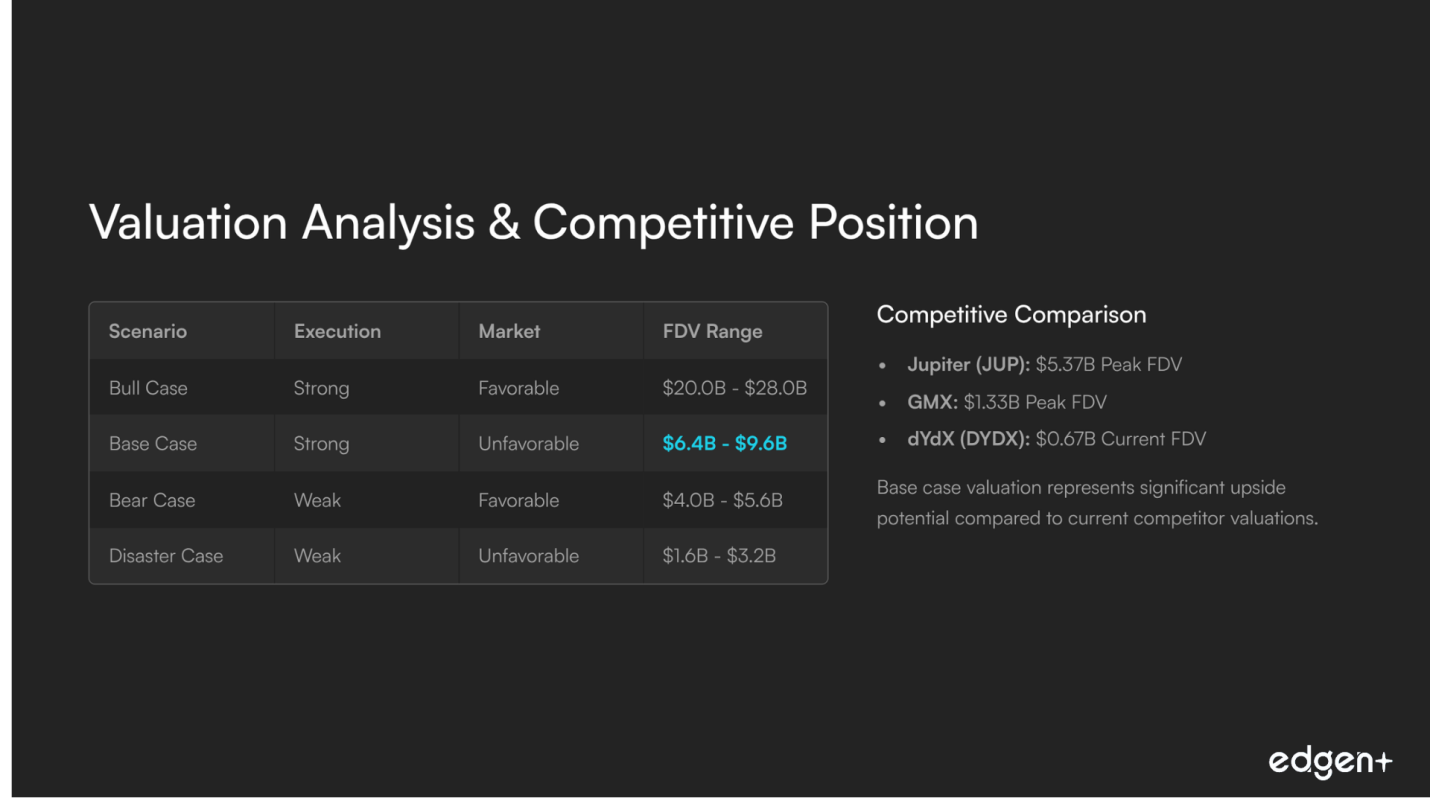

The potential FDV for Hyperliquid is highly contingent on its ability to sustain its current, powerful on-chain momentum. The following scenarios project the project's potential value based on internal execution and external market conditions.

Scenario | Execution | Market | Justification & Narrative | FDV Range (Billions USD) |

Bull Case | Strong | Favorable | Sustained on-chain growth in a risk-on market. | ~$20.0 B - $28.0 B |

Base Case | Strong | Unfavorable | Outperforms peers in a compressed market. | ~$6.4 B - $9.6 B |

Bear Case | Weak | Favorable | Growth stalls despite a bullish macro market. | ~$4.0 B - $5.6 B |

Disaster Case | Weak | Unfavorable | Stagnation meets a severe bear market. | ~$1.6 B - $3.2 B |

Competitive Landscape

Hyperliquid has established a powerful position within the on-chain perpetuals market by fundamentally differentiating on performance, architecture, and user experience. Its purpose-built L1 enables a fully on-chain order book with sub-second latency, providing a superior user experience.

The following table provides a comparison of Hyperliquid's potential Base Case valuation against its key competitors' current or peak FDVs. This highlights the significant growth potential still available to the project.

Project | Token | Peak or Current FDV (Billions USD) |

Hyperliquid | HYPE | ~$6.4 B - $9.6 B (Base Case) |

Jupiter | JUP | ~$5.37 B |

dYdX | DYDX | ~$0.67 B |

GMX | GMX | ~$1.33 B |

Final Thesis

Hyperliquid represents a project with exceptional fundamental strength and a compelling long-term trajectory. Its vertical integration as a purpose-built Layer 1 and its aggressive, revenue-driven value accrual model for the HYPE token provide it with a robust and durable competitive advantage. While facing the long-term challenge of future supply inflation and the short-term risk of a competitive market, its strong on-chain metrics, institutional backing, and proven execution capability provide a solid foundation for continued growth. Hyperliquid is more than just an exchange; it's a foundational piece of infrastructure for a new financial system, with a clear path to becoming a dominant force in decentralized finance.

.32b68d3b2129e802.png)

.ee9b0bcf9fc168ac.png)

.d8688e9eeef29939.png)