Markets Confusing? Ask Edgen Search.

Instant answers, zero BS, and trading decisions your future self will thank you for.

Try Search Now

Moonbirds: IP Revival With Real Utility

An assessment of Moonbirds under Orange Cap Games, focused on strategy, execution, partnerships, and valuation scenarios. You can find Moonbirds guide here:

TL;DR

- OCG is applying a proven IP revival playbook that moves from community to brand to products, already converting attention into activity and demand.

- Elite investor alignment, tangible utility like Kaito AI social-to-earn, Otherside avatars, and partner airdrops give Moonbirds strong momentum with clear paths to durable value.

What is Moonbirds

Moonbirds is a 10,000-supply Ethereum PFP collection that began under PROOF (Kevin Rose) with a practical utility stack: Nesting for time-based rewards, exclusive art drops, and a media-company vision. It later aligned with Yuga Labs for Otherside. In May 2025, Orange Cap Games (OCG) acquired the IP and initiated a hard reset that prioritizes community energy, accessible brand touchpoints, and product delivery, inspired by the successful Pudgy Penguins turnaround.

Led by Spencer Gordon-Sand, OCG brings crypto-native credibility and product execution experience, including the Vibes trading card game. The plan is to expand Moonbirds across digital and physical channels, build distribution on mainstream platforms, and translate community momentum into revenue and sustainable economics. Partnerships such as Kaito AI (social-to-earn) and airdrop access with projects like Monad and Towns add immediate holder value while the team builds toward a broader IP and gaming platform.

With renewed leadership, high-signal backers, and a clear operating model, Moonbirds is positioned to evolve from a storied NFT collection into a durable, utility-anchored brand.

I. Foundational & Strategic Analysis

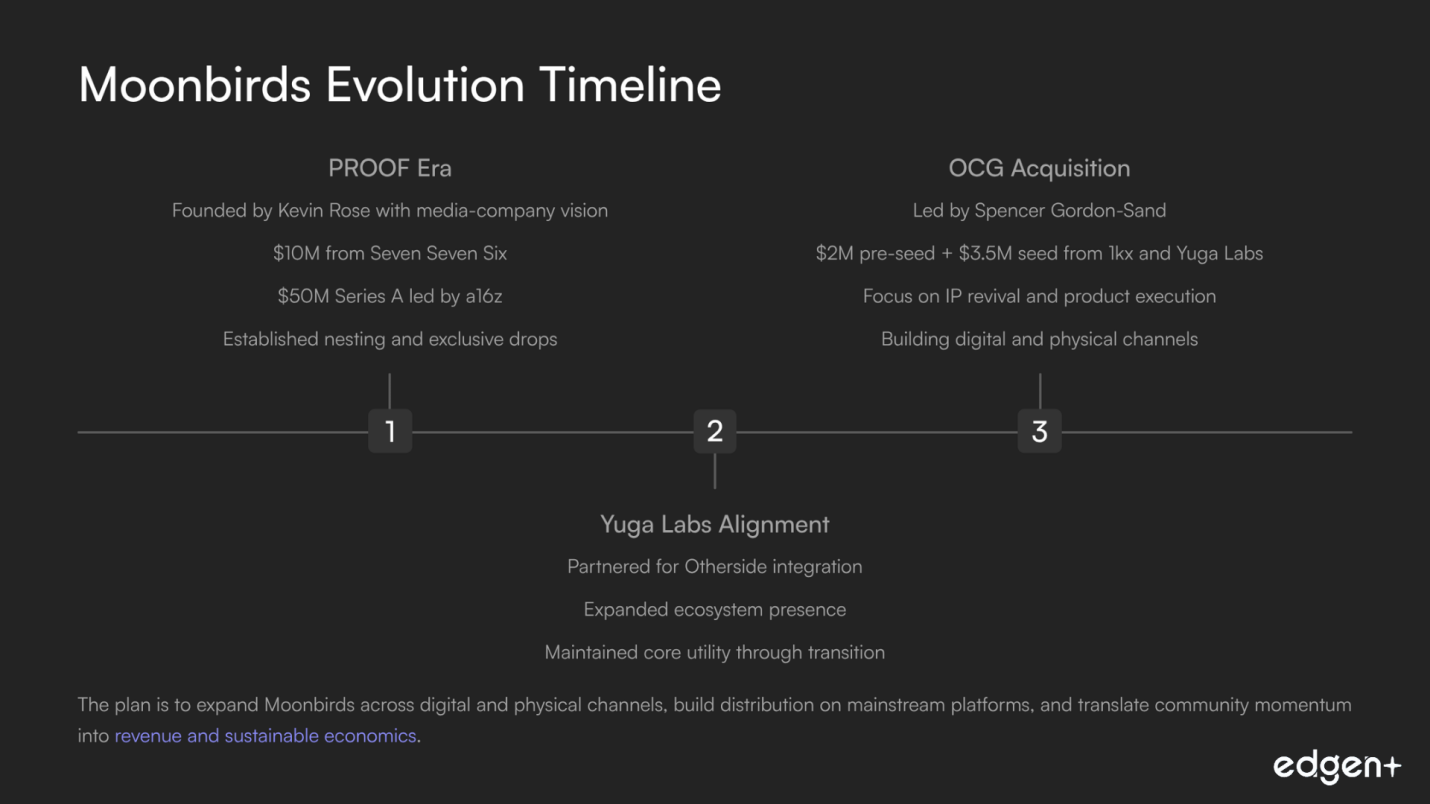

1. Vision and Investor Alignment

Strategy has evolved across three eras, from PROOF to Yuga to OCG, toward a focused mission: revive IP, energize community, and ship products.

Investor support mirrors this arc, from a16z backing PROOF’s media thesis to 1kx and Yuga Labs co-leading OCG’s seed, aligning capital with the turnaround plan.

2. Exceptional Team and Execution Prowess

- Operator-led execution from CEO Spencer Gordon-Sand, an early NFT investor and visible community leader, matched with practical product experience.

- Vibes TCG demonstrates physical and digital execution, plus an operational path to manufacturing and scale through Asia-based capabilities.

3. Capital Strength and Endorsements

Historical raises include $10M from Seven Seven Six and a $50M Series A led by a16z with top-tier participants.

Today, OCG is supported by a $3.5M seed from 1kx and Yuga Labs, following a $2M pre-seed, and augmented by revenue from Vibes. This creates a healthy, execution-focused runway.

4. Market Opportunity and Fit

- Segment: high-value PFPs inside digital collectibles, a volatile but sizable opportunity where community and brand drive compounding effects.

- Personas covered: speculators, community seekers, IP collectors, and utility users via Nesting, governance, avatars, and partner programs.

5. Competitive Landscape & Differentiators

Peers include BAYC, Pudgy Penguins, and Azuki. Moonbirds’ edge is an execution-centric playbook, in-house manufacturing leverage, a strong partner pipeline, and a comeback narrative that converts attention into measurable activity.

Foundational Take: Remarkable foundational strength with aligned investors, practical operators, and a product-led roadmap.

II. Pre-Launch Ecosystem & Go-to-Market

1. Community & Narrative Momentum

The OCG acquisition catalyzed a narrative shift. Consistent leadership communication and tangible utility announcements, such as Kaito AI, have re-energized social and on-chain activity. Signals point to improving engagement quality and a responsive holder base.

2. On-Chain Footprint

A sizable, resilient holder base provides a strong launchpad for products and token mechanics. Long-hold behavior, renewed secondary activity, and sub-collections support access while preserving brand status.

3. Partnerships that Add Utility

- Kaito AI social-to-earn converts content into rewards, turning passive holding into active participation and discovery.

- Airdrop routes like Monad and Towns reward holders and attract aligned partners seeking quality distribution; Otherside-ready 3D avatars extend cross-ecosystem utility.

4. Tokenomics & Value Accrual (Today)

- Nesting creates time-based rewards that support holding behavior and primes the system for a future $TALONS token.

- Governance through the Lunar Society ties influence to core NFTs and a treasury, reinforcing long-term alignment between participants and the brand.

GTM Readiness Take: Very promising. Utility-oriented partnerships and delivery discipline form a solid base. Token TGE readiness will benefit from continued operational and legal preparation.

III. Forward-Looking Analysis (Catalysts & Opportunities)

Near-Term (≤1 month)

Kaito AI activation compounds the creator loop, improves discovery, and supports sticky engagement that can flow into trading and partner interest.

Mid-Term (1–3 months)

First OCG-era product drop can anchor fundamentals beyond narrative and validate the operating model.

Long-Term (6+ months)

$TALONS TGE establishes public pricing for the broader economy, enables DeFi and composability, and increases surface area for partners.

Forward View: Significant opportunities, with execution cadence as the prime lever that converts momentum into durable value.

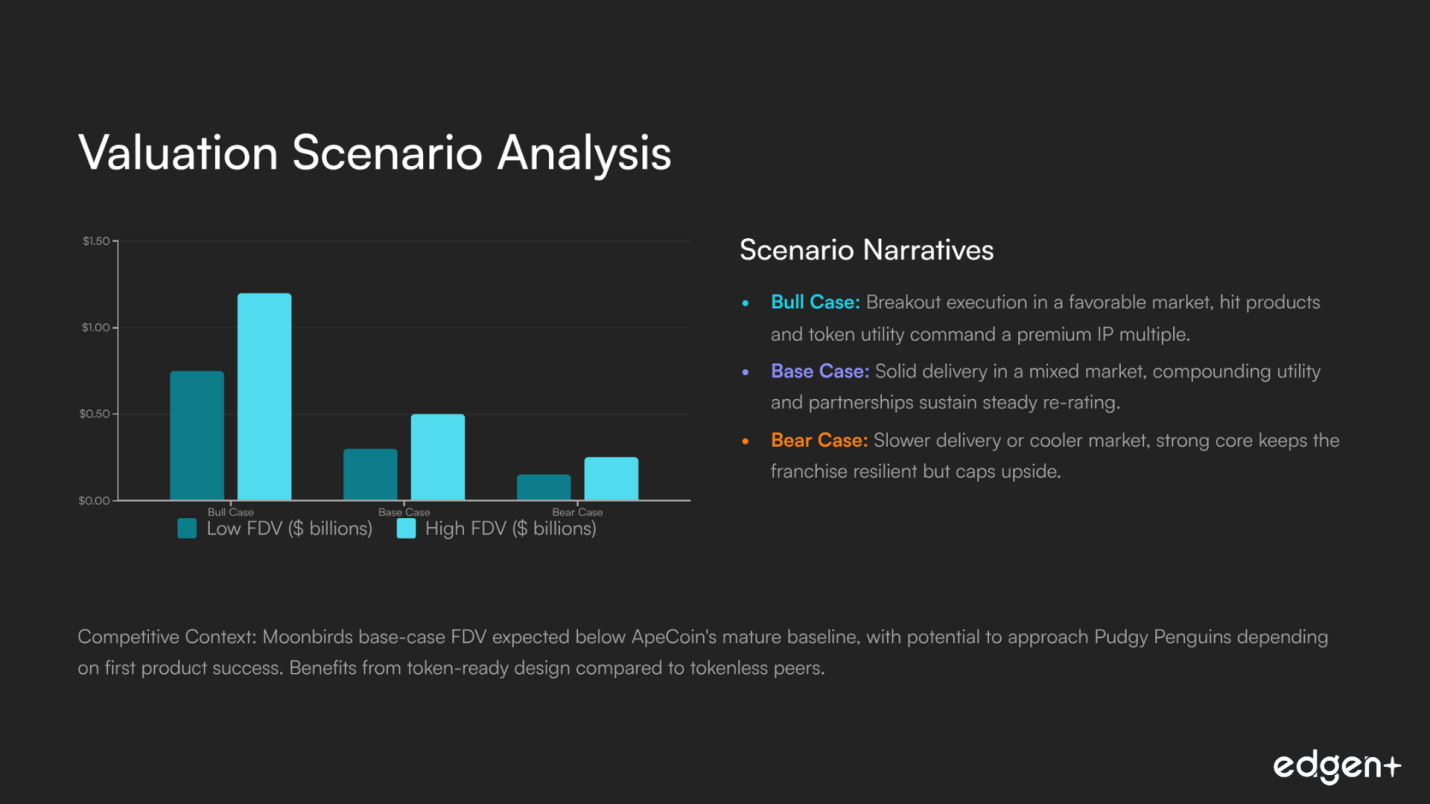

IV. Valuation Scenario Analysis (TGE FDV)

Scenario | FDV (USD billions) | Brief Narrative |

Bull Case | 0.75 – 1.20 | Breakout execution in a favorable market, hit products and token utility command a premium IP multiple. |

Base Case | 0.30 – 0.50 | Solid delivery in a mixed market, compounding utility and partnerships sustain steady re-rating. |

Bear Case | 0.15 – 0.25 | Slower delivery or cooler market, strong core keeps the franchise resilient but caps upside. |

Competitor Landscape (Token Angle at or near TGE)

Project | Token | TGE/Token Angle | Holder Linkage | Distribution Style | Position vs Moonbirds (Base-Case) |

ApeCoin / Otherside | Ecosystem utility and governance | BAYC alignment | Airdrop plus listings | Moonbirds base-case FDV expected below APE’s mature baseline, strategic ties with Yuga are additive. | |

Pudgy Penguins | IP, toys, and gaming flywheel | Penguin holders | Community-aligned | Moonbirds base-case FDV near or below PENGU, contingent on first product success. | |

Azuki | (none) | Brand and anime-forward IP | Collection-driven | N/A | Tokenless peer benchmark, Moonbirds benefits from token-ready design for added accrual. |

Final Take

Moonbirds shows strong potential as a professionally run IP revival with authentic community roots and practical product paths. With elite investor alignment and early utility traction, the project looks very promising. Execution speed and quality remain the key to unlocking the upper bands of the valuation range.

Educational content, not financial advice.

.32b68d3b2129e802.png)

.ee9b0bcf9fc168ac.png)

.d8688e9eeef29939.png)