Markets Confusing? Ask Edgen Search.

Instant answers, zero BS, and trading decisions your future self will thank you for.

Try Search Now

The Sahara AI Network: Pioneering the Decentralized AI Economy

Sahara AI is a foundational infrastructure project creating an open, equitable, and collaborative future for artificial intelligence through decentralized technology. For simple guide, click here

TL;DR

- A Visionary Foundation: Sahara AI is building the essential, full-stack infrastructure for a new, decentralized AI economy, positioning itself as the "Ethereum of AI."

- Elite Team & Backing: The project is led by a rare combination of a world-renowned AI academic and a veteran crypto venture capitalist, and it's backed by a premier syndicate of institutional investors.

- Major Catalysts Ahead: The near-term is dominated by a major catalyst: the mainnet launch, which is poised to fundamentally re-rate the project.

What Is The Sahara AI Network?

The Sahara AI Network is a decentralized AI infrastructure platform designed to democratize the creation, training, and distribution of artificial intelligence assets. It aims to solve the problem of centralized control in the AI sector by creating an open and transparent ecosystem built on blockchain technology.

At its core, Sahara AI is an L1 blockchain built on the Cosmos SDK, which acts as the "source of truth" for all AI-related intellectual property. The platform allows users to own, monetize, and share AI assets like datasets and models through a unique on-chain licensing framework. By leveraging a hybrid architecture that combines the security of a blockchain with the efficiency of off-chain computation, Sahara AI offers a solution that is both decentralized and performant. Its ecosystem includes a Data Services Platform, an AI Developer Platform, and an AI Marketplace, creating a powerful flywheel for growth. This integrated approach distinguishes Sahara AI from single-purpose competitors, positioning it as a comprehensive solution for a new, collaborative AI economy.

Part I: Foundational & Strategic Analysis

Strategic Direction & Narrative Trajectory

Sahara AI’s strategic direction is exceptionally well-aligned with several of the most potent, high-conviction market narratives anticipated to dominate the 2025-2026 cycle: the convergence of Artificial Intelligence and cryptocurrency, the decentralization of physical infrastructure (DePIN), and the establishment of digital property rights for AI-generated assets. The project's stated mission is to "democratize the process of building, training, and distributing artificial intelligence assets" and to create an "open, equitable, and collaborative AI future." This vision directly addresses the core tenets of the decentralized AI (DeAI) movement, which seeks to provide a community-owned alternative to the centralized control of AI development by large technology corporations. Evidence of this alignment is found in market analysis from Q2 2025, where reports from sources like Coin World and The Economic Times identified AI tokens as a "high-conviction investment theme," with the market cap for the sector adding nearly $10 billion in a single week.

The project's focus on verifiable provenance and on-chain monetization directly intersects with the emerging trend of tokenizing real-world assets (RWAs) and intellectual property. The core problem Sahara AI aims to solve—that contributors of data and models are often uncompensated for the value they create—is a primary concern that blockchain technology is uniquely suited to address. Research from event intelligence highlights that key features driving the AI token narrative include "tokenized incentive models for AI data sharing," "AI-powered oracles," and "autonomous AI agents," all of which are explicitly part of Sahara's roadmap and product design. The strategic implication is that Sahara AI is not just following a trend but is actively building the infrastructure to enable it. This positions the project as a potential category leader, providing the tools for a collaborative economy rather than just being another application within it. This foundational approach, if successful, could create a durable competitive moat and establish the $SAHARA token as a key utility asset within the broader DeAI ecosystem.

Product & Technology Prowess

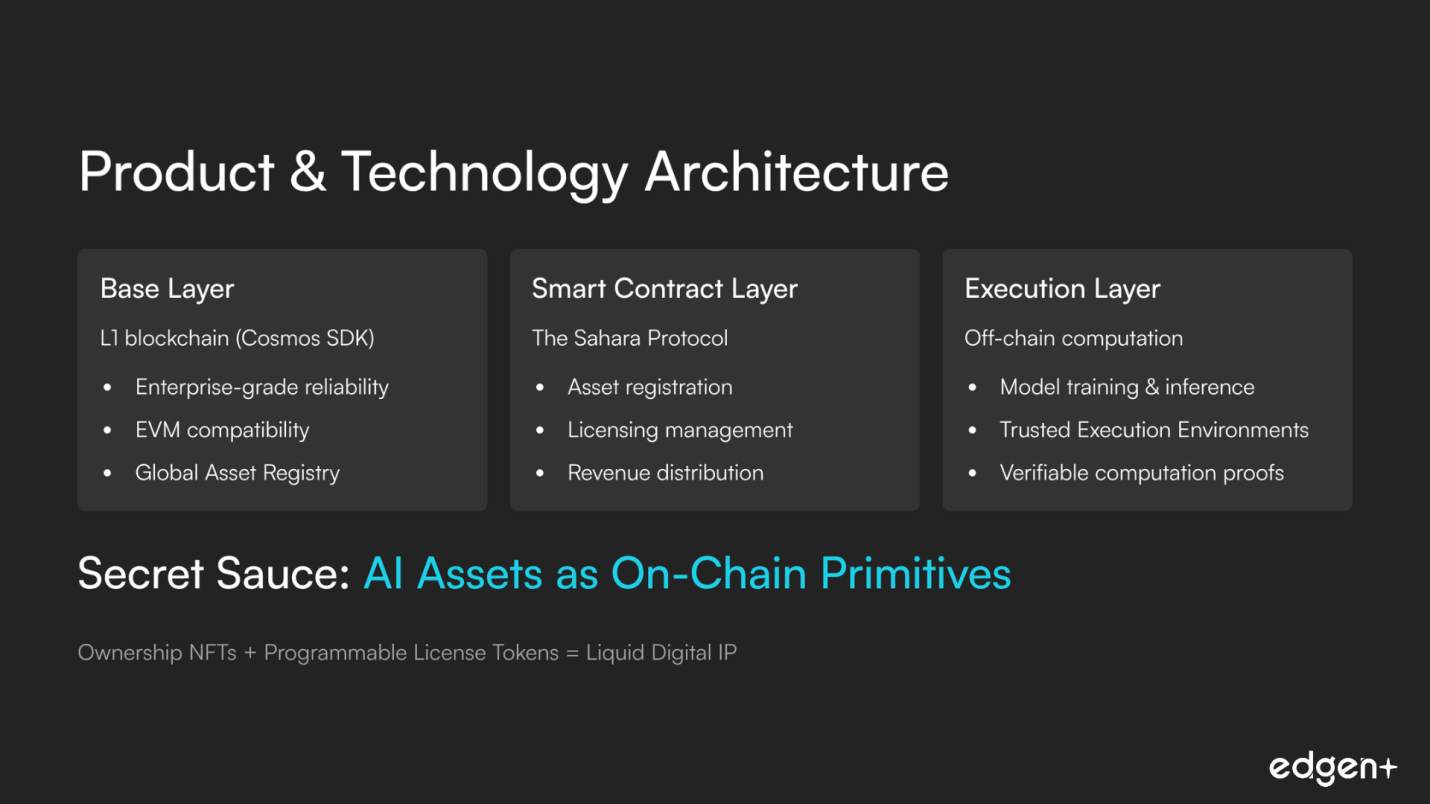

Sahara AI's platform is engineered around a sophisticated hybrid architecture designed to balance the transparency and immutability of blockchain with the performance requirements of intensive AI computation. This architecture is structured in multiple layers, primarily a Base Layer (the Sahara Network), a Smart Contract Layer (the Sahara Protocol), and an Execution Layer. The Base Layer is a Layer-1 blockchain built using the Cosmos SDK, which provides enterprise-grade reliability and interoperability, while also featuring full EVM compatibility to attract the large existing pool of Ethereum developers. This on-chain component is explicitly designed to handle the "source of truth" for AI assets—managing their registration, metadata, licensing, and revenue distribution through a Global Asset Registry. The Execution Layer, in contrast, operates largely off-chain to handle computationally expensive tasks like model training and inference. This layer leverages Trusted Execution Environments (TEEs) to ensure that even off-chain computations are performed in a secure, private, and tamper-proof manner, with verifiable proofs of these computations anchored back to the Sahara Blockchain. The primary implication of this hybrid design is that it pragmatically solves the blockchain trilemma for AI applications. It avoids the prohibitive cost and low throughput of performing all AI computations on-chain while still using the blockchain for its core strengths: providing a transparent, immutable, and globally accessible ledger for ownership and value exchange.

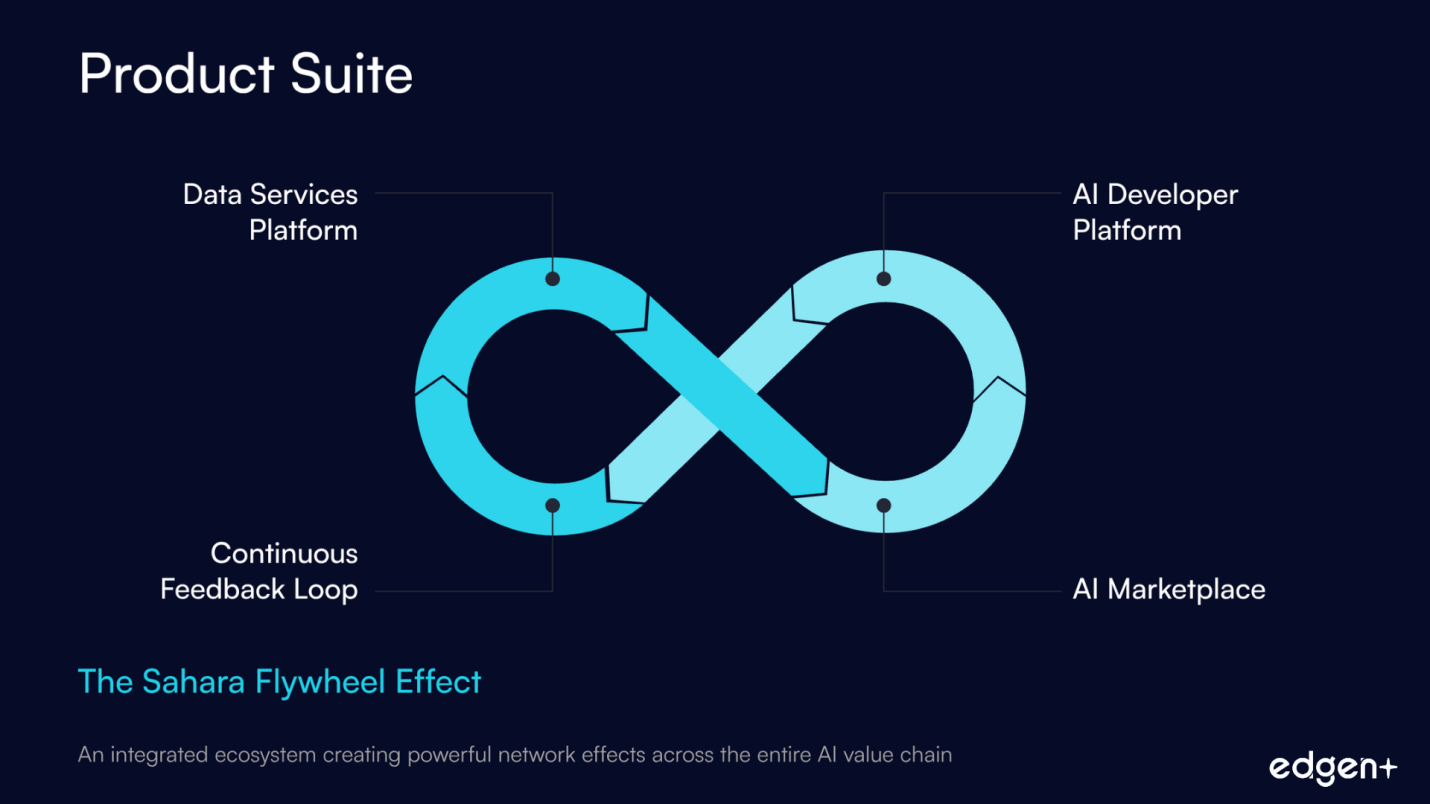

The platform's product suite is a direct manifestation of this architecture, offering an end-to-end ecosystem for the entire AI development lifecycle. The three flagship applications are the Data Services Platform (DSP), the AI Developer Platform, and the AI Marketplace. The DSP functions as a decentralized data factory, allowing a global network of contributors to collect, label, and refine datasets for AI training. The AI Developer Platform provides a comprehensive suite of tools, including the "Sahara Studio," for developers to build, train, and deploy AI models. Finally, the AI Marketplace serves as the economic hub, a decentralized exchange where AI assets—datasets, models, and agents—can be bought, sold, and licensed. The implication of this integrated product suite is a powerful potential flywheel effect: more high-quality data from the DSP attracts more developers to the AI Developer Platform, who in turn create more valuable models and agents to be monetized on the AI Marketplace, which then drives demand for more data, completing the loop.

The core innovation and "secret sauce" of Sahara AI lies in its holistic, full-stack approach and its formalization of "AI Assets" as on-chain primitives. Unlike competitors that may focus on a single vertical like decentralized compute (e.g., Akash) or data indexing (e.g., The Graph), Sahara AI aims to be the unified infrastructure layer for the entire AI value chain. This is operationalized through its unique on-chain mechanics for asset registration and licensing. When an asset is created, it is registered in the Global Asset Registry, minting an "Ownership NFT" that grants absolute control. Monetization and access are then managed through programmable "License Tokens," which can codify complex terms such as commercial use, revenue sharing, and API access on-chain. The strategic implication of this mechanism is profound: it transforms abstract intellectual property into tangible, programmable, and liquid digital assets. This provides a clear and defensible differentiator, moving beyond simply applying blockchain to AI and instead creating a novel, crypto-native framework for a collaborative AI economy.

Market Adoption & Developer Activity

Sahara AI has demonstrated remarkable market momentum by cultivating a massive social media presence and generating significant on-chain activity during its testnet phases, indicating strong product-market fit with its target user base. The evidence for this is robust and quantitative: the official Sahara AI X (formerly Twitter) account, @SaharaLabsAI, has amassed over 852,700 followers, while its official Discord server counts over 372,000 members. This large and engaged community translated into impressive testnet participation metrics, with reports from May 2025 citing over 3.2 million total on-chain accounts created and a peak of 1.4 million daily active accounts during the private testnet. The clear implication is that Sahara AI's go-to-market strategy and incentive programs have been highly effective at capturing community attention and driving initial user adoption, creating a strong foundation for its upcoming mainnet launch.

Team & Backers

The execution capability of Sahara AI is significantly bolstered by a core leadership team that possesses a rare and synergistic combination of world-class academic AI expertise and seasoned, crypto-native venture experience. The evidence for this is manifest in the professional backgrounds of its co-founders. CEO Sean (Xiang) Ren is a tenured Associate Professor of Computer Science at the University of Southern California (USC), where he directs the Intelligence and Knowledge Discovery (INK) Lab. His credentials include numerous prestigious awards, such as the NSF CAREER Award, Samsung AI Researcher of the Year (2023), and recognition in both MIT Technology Review's "Innovators Under 35" and Forbes' "30 Under 30." This academic rigor is complemented by COO Tyler Zhou, who previously served as an Investment Director at Binance Labs, the venture capital arm of the world's largest cryptocurrency exchange. His experience provides deep insight into the crypto market's structure, tokenomics design, and strategic growth levers. The implication of this leadership composition is a dramatic reduction in execution risk; the team is uniquely equipped to navigate the dual complexities of building a cutting-edge AI platform while simultaneously architecting a successful Web3 economic and governance model.

This strong foundation is further reinforced by the broader team and advisory board, which includes talent from leading institutions like Google Brain, Fetch.ai, and Ocean Protocol, as well as advisors from prominent AI firms such as Anthropic and Midjourney. The project's ability to attract such high-caliber individuals speaks to the perceived viability and ambition of its vision.

Brand & Ecosystem Longevity

Sahara AI is supported by a premier consortium of institutional investors, blending top-tier crypto-native venture capital firms with strategic corporate backers, which signals exceptionally strong market conviction in its long-term vision. The evidence for this is the successful closure of funding rounds totaling over $51.5 million, including a $43 million Series A co-led by industry giants Pantera Capital, Polychain Capital, and Binance Labs. The participation of these firms is significant, as they are among the most respected and successful investors in the blockchain space, known for their rigorous due diligence and long-term strategic support. The investor list is further strengthened by the inclusion of Sequoia Capital, Samsung Next, and Matrix Partners, indicating that the project appeals not only to crypto-native funds but also to traditional VCs and corporate venture arms seeking exposure to foundational Web3 infrastructure. The implication of this high-caliber backing extends far beyond capital; it provides Sahara AI with an invaluable strategic network for partnerships, technical guidance, exchange listings, and enterprise adoption, substantially de-risking its path to market.

Part II: On-Chain & Market Depth Analysis

Sustainable Tokenomics & Value Accrual

The SAHARA token's economic model is designed to create demand through a variety of utility-based mechanisms integrated into its ecosystem. The primary demand drivers for the SAHARA token are:

- AI Asset Access and Licensing: Users must use SAHARA tokens to pay for access to datasets, AI models, and computational resources on the AI Marketplace.

- Per-Inference Payments: The model allows for granular, usage-based pricing for AI agents, where payments are made in SAHARA.

- Network Operations: Once the Sahara Mainnet launches, SAHARA will be used to pay for transaction fees (gas).

- Validator Staking: To become a validator on the future Proof-of-Stake network, participants will be required to stake SAHARA as collateral.

- Governance: Token holders will have voting rights on protocol upgrades and decisions, incentivizing long-term holding.

While the project outlines several demand drivers, it currently lacks a direct, programmatic deflationary mechanism. The official documentation explicitly states there is "no automatic burn or deflation mechanism." The only confirmed mechanism to counter inflation is through demand-side growth and staking, which temporarily removes tokens from circulation.

The value accrual mechanism for the SAHARA token is designed to be directly linked to the platform's utility and adoption. The core concept is to create a self-sustaining "collaborative AI economy" where the token facilitates all transactions. Revenue generated from the AI Marketplace and the Data Services Platform is intended to flow back to the ecosystem. The primary mechanism for direct value accrual to token holders is through staking rewards. Validators and their delegators will earn a portion of the network's transaction fees and new token emissions.

Token Holder Distribution & On-Chain Metrics

Analysis of on-chain data for the SAHARA token shows a significant portion of the supply (64.25%) is allocated to "Community-Focused" initiatives, which likely includes airdrops, ecosystem grants, and incentives. This suggests a wide initial distribution is planned. The large allocations to early backers (19.75%) and the team (15%) represent a concentration risk, although this is mitigated by long-term vesting schedules (1-year cliff, 3-year linear vest). Transaction data from Etherscan shows frequent, large-volume transfers to and from major centralized exchanges like Binance, KuCoin, and Upbit, which is typical following a new listing. The significant price drop following a July 26, 2025 unlock suggests that some early recipients are taking profits, a common pattern for newly launched tokens.

Awareness & Mindshare Analysis

As previously noted, Sahara AI exhibits powerful market momentum, evidenced by its massive social media following and high testnet user engagement. However, its public developer activity appears low, suggesting that core development is occurring in private repositories, which is common for well-funded, pre-mainnet projects. While the community and user metrics are strongly bullish, the assessment of developer momentum relies on trusting the project's roadmap announcements and team credibility rather than verifiable public code contributions at this stage. This is a point to monitor as the project matures.

Part III: Forward-Looking Analysis (Catalysts & Risks)

The forward-looking outlook for Sahara AI presents a profile of high-stakes, binary events. The mid-term is defined by the critical mainnet launch, a catalyst with the potential to fundamentally re-rate the project. The long-term picture is dominated by a massive supply-side risk from team and investor unlocks beginning in mid-2026, which poses a severe threat to sustained price appreciation.

Near-Term Outlook (<1 Month)

- Upcoming Token Unlocks: A recurring risk is the scheduled monthly token unlocks. These events introduce direct, quantifiable sell pressure and have historically led to price drawdowns, establishing a clear pattern. The market is sensitive to these emissions, and the upcoming unlock in late August 2025 is likely to create downward pressure.

- Market Misinformation: An ongoing risk is conflicting information regarding the token's economic model. The persistent, erroneous reports of buybacks and burn mechanisms in some news outlets create a fragile price structure. If the market reprices based on the true, fixed-supply nature of the tokenomics, a correction could occur.

Mid-Term Outlook (1-3 Months)

- Sahara Chain Mainnet Launch (Catalyst): This is the most significant near-to-mid-term catalyst. A successful and timely launch would likely trigger a major wave of buying pressure, as it would activate the full scope of the token's utility. This event is a crucial de-risking milestone that could re-rate the project's valuation.

- Competitor Activity (Risk): The launch of Bittensor's (TAO) EVM compatibility poses an indirect risk. A successful rollout for Bittensor could attract speculative capital, leading to relative underperformance for Sahara AI. This increases competitive pressure and requires Sahara to successfully differentiate itself.

Long-Term Outlook (6+ Months)

- Bittensor Halving (Risk): This event, scheduled for December 2025, poses a significant narrative and capital-flow risk. As TAO’s tokenomics mirror Bitcoin’s, the halving is likely to attract immense speculative attention, potentially rotating capital away from other projects in the sector.

- Team & Early Backer Token Unlock Cliff (Risk): This is the most significant long-term structural risk. The end of the 1-year cliff in mid-2026 will introduce a substantial supply overhang. With over 3.4 billion tokens from team and early backer allocations set to begin vesting, there is a high probability of severe, sustained selling pressure as insiders begin to realize their gains. The project's success is contingent on its ability to generate substantial, defensible protocol demand before this major inflationary event occurs.

Part IV: Valuation & Competitive Position

Valuation Scenarios

This analysis synthesizes the project's fundamental strengths, tokenomic structure, and forward-looking catalysts into a valuation matrix based on the project’s fully diluted valuation (FDV). The framework evaluates potential outcomes based on two critical, independent variables: the project's internal execution capability and the external crypto market conditions over the next 6-12 months.

Scenario | FDV Target Range | Justification & Narrative |

Bull Case | ≈ $7.0 B – $9.5 B | A flawless mainnet launch and a raging bull market propel Sahara to its cycle-peak valuation as a leader. |

Base Case | ≈ $2.2 B – $3.5 B | The team executes well, but a muted market caps the valuation, reflecting solid fundamentals at a discount. |

Bear Case | ≈ $1.3 B – $2.2 B | Flawed execution, yet a bull market provides speculative support, with the valuation lagging peers. |

Competitive Landscape

Sahara AI operates in an increasingly competitive but still formative decentralized AI landscape, differentiating itself through its ambitious full-stack, end-to-end ecosystem approach. While direct competitors are emerging, the most established benchmarks in the broader AI x Crypto space are Bittensor (TAO) and The Graph (GRT). A qualitative evaluation positions Sahara AI distinctly from these peers.

- Bittensor (TAO): Bittensor primarily focuses on creating a decentralized network for training and running AI models, essentially a marketplace for machine intelligence. It's a key benchmark for the AI sector.

- The Graph (GRT): The Graph is a decentralized indexing protocol, solving the problem of accessing and querying blockchain data efficiently.

Sahara AI’s strategy subsumes and expands upon these functions; it aims to provide not only the marketplace for models (like Bittensor) and the data infrastructure (akin to The Graph's purpose) but also the entire lifecycle of tools for data creation (Data Services Platform) and model development (Sahara Studio). This integrated approach is its key differentiator and potential long-term defensibility.

Project | Base Case FDV | Primary Function | Key Differentiator |

Sahara AI | $2.2 B – $3.5 B | Full-stack AI Infrastructure | Integrated end-to-end ecosystem with on-chain "AI Assets" |

Bittensor (TAO) | $7.18 B (Current) | Decentralized AI Marketplace | P2P network for machine intelligence |

The Graph (GRT) | $0.97 B (Current) | Decentralized Indexing Protocol | Centralized blockchain data for dApps |

Final Thesis

Sahara AI presents as a project with exceptionally strong fundamentals, underpinned by a world-class team, top-tier institutional backing, and a strategic vision that is perfectly aligned with the powerful decentralized AI narrative. The project’s ambitious, full-stack product vision and innovative on-chain "AI Asset" framework provide a clear and defensible long-term value proposition. However, this potential is counterbalanced by significant structural risks, most notably the immense future token inflation from a large, uncirculated supply and the considerable execution risk associated with its complex technical roadmap. The most probable outcome over the next 6-12 months is the Base Case scenario, where the team successfully executes its mainnet launch but broader market conditions limit the valuation ceiling. The project's long-term potential to become a category-defining leader is contingent on flawless execution to generate substantial, defensible protocol demand before the major team and investor token unlocks begin in mid-2026.

.32b68d3b2129e802.png)

.ee9b0bcf9fc168ac.png)

.d8688e9eeef29939.png)